All About SIP

What is SIP?

A Systematic Investment Plan (SIP), more popularly known as SIP, is a facility offered by mutual funds to the investors to invest in a disciplined manner. SIP facility allows an investor to invest a fixed amount of money at pre-defined intervals in the selected mutual fund scheme. The fixed amount of money can be as low as Rs. 500, while the pre-defined SIP intervals can be on a weekly/monthly/quarterly/semi-annually or annual basis. By taking the SIP route to investments, the investor invests in a time-bound manner without worrying about the market dynamics and stands to benefit in the long-term due to average costing and power of compounding

Benefits of SIP Investing

Power of Compounding

When you invest regularly through SIP and invest for the long term, the benefits are magnified by the compounding effect. Compounding effect ensures that you earn returns not only on your principal amount (actual investment) but also on the gains on the principal amount i.e. your money grows over time as the money you invest earns returns. And the returns also earn returns.

Power of Starting Early

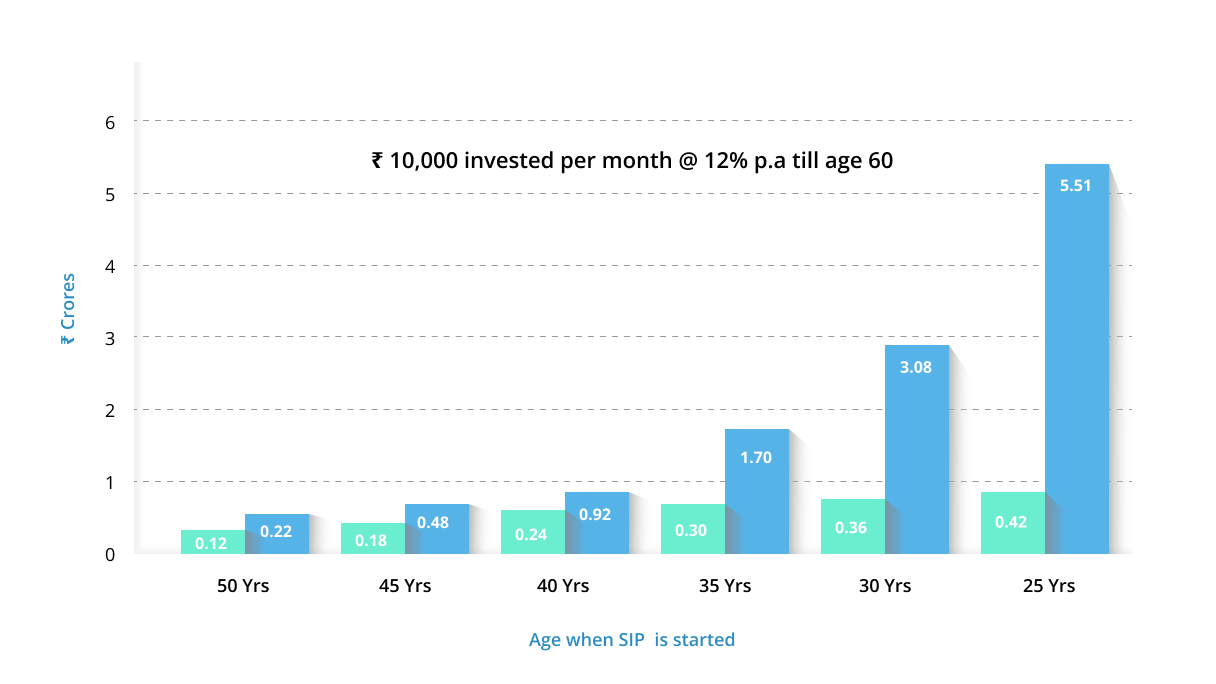

The earlier one starts saving and investing regularly, the easier it is to achieve your goals. The graph below shows the impact of beginning to invest Rs.10,000 monthly at various stages of life till the age of 60 years (assuming a return of 12% p.a.).

Source : Internal

Value of investment on Retirement

Amount invested via SIP

If you start SIP at age 30, as per the illustration shown a corpus of approximately Rs. 3 crores can be generated at retirement. If you would have waited 10 years and started SIP at age 40, a corpus of approximately Rs. 0.9 crore would have been available to you at retirement i.e. a difference of Rs. 2.1 crore – which is the ‘cost of delaying starting SIP’

Goal based SIP Investing

We have many financial goals in life but do not know how to plan and invest for them. To plan your financial goals right, it is important to identify each goal in terms of a specific amount and the number of years that it will take to meet them. This is the essence of goal-based investing.

Know MoreTop Up SIP

This Top -Up in your SIP allows your investments to be in line with the increase in the cost of living or inflation and helps you plan for your financial goals right. It can also help you reach your financial goals earlier or create a larger corpus for your goal.

Helps save more in tandem with rising income – We expect our salaries or business income to rise annually by a certain percentage. If you Top-up your SIPs annually by the expected increase in your income, then it auto adapts to your rising income.

Frequently asked questions

What is the benefit of SIP?

Systematic Investment Plan (SIP) allows you to invest a fixed amount at regular intervals in a scheme. There are many benefits of investing in a SIP.

- Power of compounding - Investing in SIP allows the investor to take advantage of the power of compounding. Regular investments in a scheme leads to compounding which means you earn interest on your interest as it is added to the original amount. This is very beneficial for long term wealth creation.

- Rupee cost averaging - When an investor invests through SIP, he gets the benefit of rupee cost averaging. It means that the investor gets more units when the Net Asset Value (NAV) of the scheme is low and less units when the NAV is high. This brings down average cost of units over the long term.

- Flexibility - An investor has the flexibility to choose the amount, duration and the interval of the SIP. They also have the option to change the amount, pause or stop the SIP.

- Disciplined investing - Investment via SIP inculcates the value of disciplined investing in an investor as they are committed to investing a specific amount for a fixed period of time which is essential in long term wealth creation.

What is a SIP? How does it work?

A Systematic Investment Plan (SIP) is an investment tool which allows the investor to invest a fixed amount at regular intervals in a Mutual Fund scheme.

SIP works by investing a fixed amount at a defined frequency. With this an investor does not need to time the market and can invest in a hassle-free manner.

What is the minimum amount to invest in SIP?

The minimum amount an investor can invest in SIP may differ according to the scheme they want to invest in. For more information click on this link https://www.sbimf.com/en-us/investment-solutions or contact your financial advisor.

How to automatically renew the SIP?

To renew the SIP an investor has to fill a fresh form and start a new SIP and choose the desired duration.

Can you increase the duration of SIP?

An investor can start a fresh SIP and choose the desired duration by filling in a fresh SIP enrollment form, start a new SIP online or through Investap.

What happens if I miss an SIP installment?

Missing a SIP instalment does not lead to any penalty however missing 3 consecutive instalments leads to cancelling of the SIP.

What is Top up SIP?

Top up SIP is a facility which allows an investor to increase the amount of SIP instalments by a fixed amount at pre-determined intervals

What is power of compounding?

Power of compounding is a concept in which interest earned on the investment is reinvested which leads to compounding of interest and helps in long term wealth creation.

What is the difference between Top- up SIP and SIP?

Top up SIP is a facility in which an investor can increase the amount of SIP instalments by a fixed amount at pre-determined intervals whereas SIP is a facility in which a fixed amount is invested at pre-determined intervals.

What is meant by “Rupee Cost Averaging?

Rupee cost averaging is a concept which allows an investor to take advantage of the market volatility. By investing in a SIP, an investor gets more units when the Net Asset Value (NAV) is less and less units when the NAV is high. This brings down the average cost of the units over the long term.

An Investor Education and Awareness Initiative.

Investors should deal only with registered Mutual Funds, details of which can be verified on the SEBI website (https://www.sebi.gov.in ) under ‘Intermediaries/Market Infrastructure Institutions’. Please refer to website of mutual funds for process for completing one-time KYC (Know Your Customer) including process for change in address, phone number, bank details etc. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with their responses. SCORES facilitates you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Loading...